In 2024, cash accounted for 16% of all payments — the third most common method after credit and debit cards. The global ATM market is projected to reach $45.49 billion by 2029. In many regions, especially underserved communities where digital payment infrastructure is limited, cash remains the primary way people transact.

For financial institutions, this means ATM networks need to work reliably. Downtime affects customers, costs money, and can create security risks. That makes monitoring not optional but necessary.

Why ATM Monitoring Matters

Running an ATM network today involves more than checking whether machines are online. Banks need to track transactions in real time, manage cash levels efficiently, detect security threats, and meet regulatory requirements — all while keeping the customer experience smooth across different locations.

Basic monitoring tools often cannot handle this complexity. What institutions actually need is visibility into everything: network connectivity, hardware health, cash status, and transaction patterns. When an ATM fails, customers get frustrated, service calls cost money, and potential security gaps appear.

Two requirements stand out above everything else: security and customizability. Security protects sensitive data and operations. Customizability lets each institution adapt monitoring to how they actually work.

How NetXMS Handles ATM Monitoring

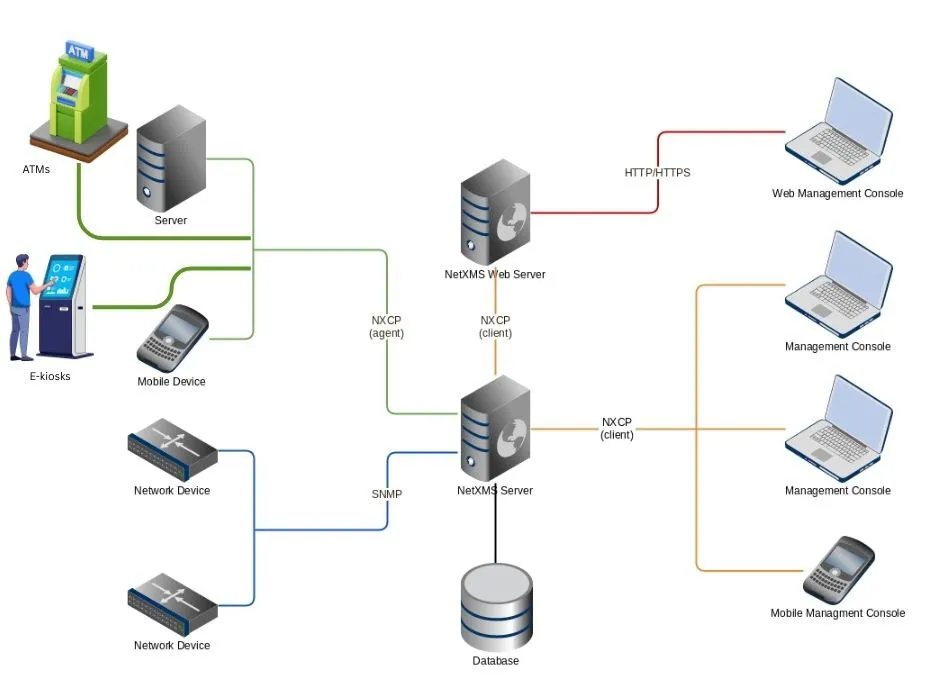

NetXMS provides a single platform for monitoring multivendor ATM networks. You get real-time information about network health, terminal status, transactions, and cash levels in one place.

The system works through a central monitoring server that receives encrypted data from NetXMS agents installed on each ATM. This agent-based approach works across multi-vendor environments — you do not need different tools for different ATM manufacturers. All communication uses industry-standard encryption and authentication.

One practical advantage: you can monitor your entire IT infrastructure alongside your ATMs using the same system. This eliminates the overhead of running separate monitoring platforms for different parts of your technology stack.

The system runs autonomously. When you add new ATMs to your network, they are discovered automatically. Historical data is retained according to your configured policies without manual intervention.

Custom Solutions for Specific Needs

Every bank operates differently. Regulatory requirements vary by region. Customer expectations differ by market. NetXMS’s modular architecture allows institutions to build monitoring solutions that fit their specific situation rather than forcing them into a one-size-fits-all approach.

Custom implementations typically include dashboards designed for different roles. A system administrator needs detailed technical metrics. An executive wants high-level operational summaries. Each stakeholder can see relevant information in a format that helps them make decisions.

Example: Iris Recognition Monitoring

Iris recognition in ATMs works by scanning the unique patterns in a person’s iris (the colored ring around the pupil — even identical twins have different iris patterns) to verify their identity instead of or alongside a PIN. The iris is highly stable throughout life unlike facial features, extremely difficult to forge, and the patterns are more unique than fingerprints.

One recent custom implementation of NetXMS ATM monitoring solution integrated iris recognition technology for high-security ATM locations. The NetXMS platform receives real-time data to monitor the health of the camera and alerts if there’s any malfunction.

The NetXMS platform is designed to evolve alongside ATM technology, supporting flexible integration of new hardware components as security standards and device types change.

It also monitors the biometric hardware itself, tracking image quality and sensor calibration so maintenance can happen before failures occur.

Example: Alternative ATM Location Services

Another custom solution we came up for our client addresses what happens when an ATM goes down. Instead of leaving customers stranded, the system displays nearby alternative ATMs on the screen. Isn’t it practical?

NetXMS continuously monitors which ATMs are operational, their cash levels, and what services they can provide. When a terminal has problems, it automatically identifies nearby alternatives based on distance, current status, and available services. Customers see clear information about where else they can go, including distances and what services are available.

The system can also analyze usage patterns to predict when disruptions might occur, allowing alternative locations to be displayed before customers even arrive at an affected terminal.

AI-Powered Monitoring in NetXMS 6

Starting with NetXMS 6, ATM monitoring gains AI-powered capabilities that change how operators interact with the system. For a detailed look at these features, see our article on AI-powered network management in NetXMS 6.

Predictive Analytics

The AI capabilities open the door to predictive analytics for ATM networks. Instead of reacting to problems after they happen, the system can analyze historical patterns — transaction volumes, hardware performance metrics, cash depletion rates — and identify potential issues before they cause downtime.

For example, the AI can learn that certain ATMs consistently run low on cash on Friday afternoons, or that a particular terminal’s card reader shows performance degradation that typically precedes failure. This shifts maintenance from reactive to proactive, reducing both downtime and emergency service calls.

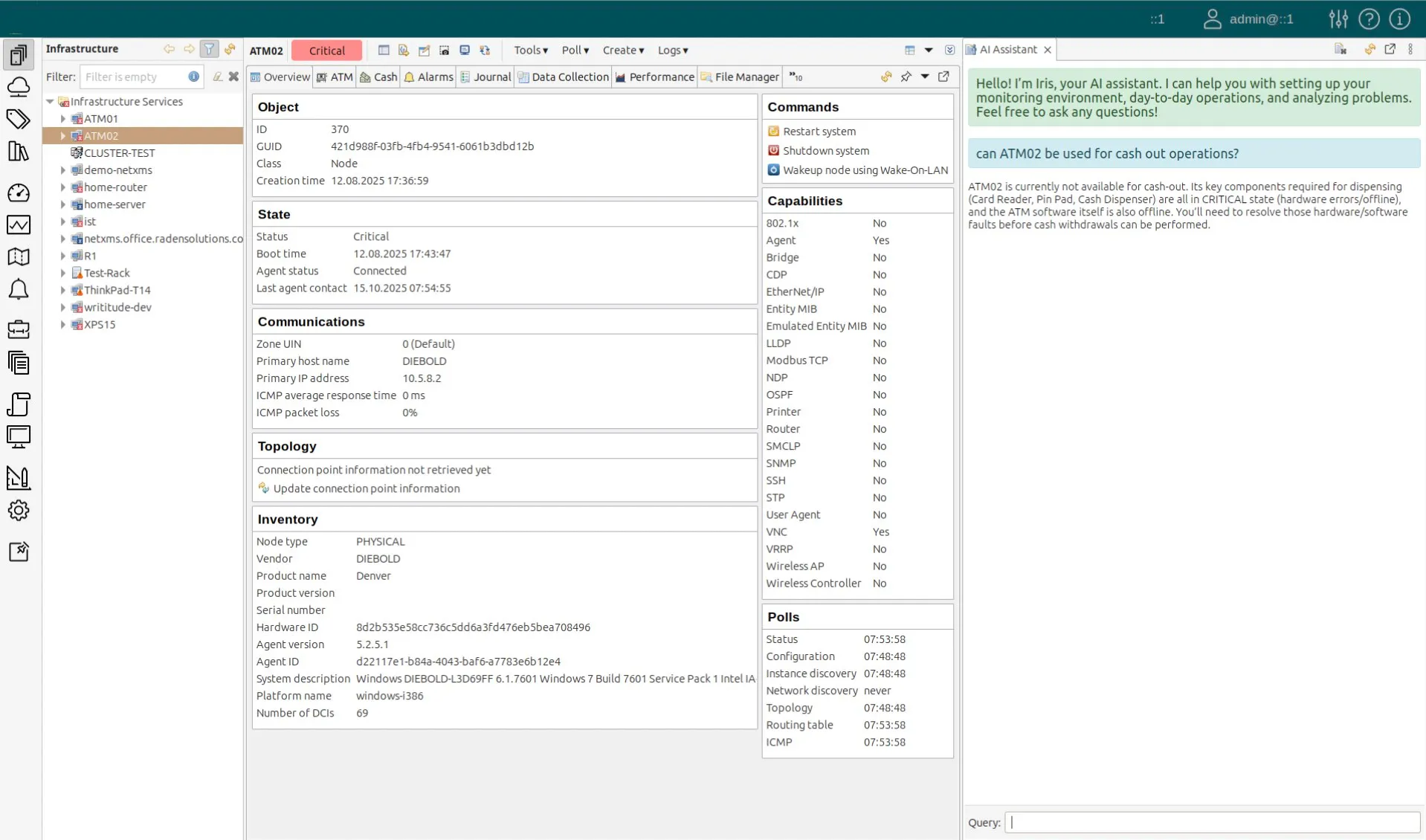

Natural Language Interaction

The AI Assistant allows operators to query the system using natural language. Instead of navigating through menus and building complex reports, staff can simply ask questions: “Which ATMs in the downtown region had the most cash-outs yesterday?” or “Show me terminals that have been rebooted more than twice this week.”

This matters particularly for less technical staff. Branch managers, regional supervisors, or customer service teams can get information they need without learning the intricacies of monitoring software. The barrier to accessing operational data drops significantly.

Automated Analysis and Response

The AI Agent can operate autonomously, executing scheduled tasks without human involvement. You might configure it to analyze alarm patterns every morning and send a summary to the operations team, or to automatically put terminals into maintenance mode when specific conditions are met.

When alarms occur, the AI can automatically attach analysis of possible causes and recommended actions. Operators see not just that something went wrong, but context about what might have caused it and what to try first.

These AI features integrate with NetXMS’s existing scripting capabilities, so institutions can extend and customize the AI’s behavior to match their specific operational procedures.

Beyond Monitoring: Active Management

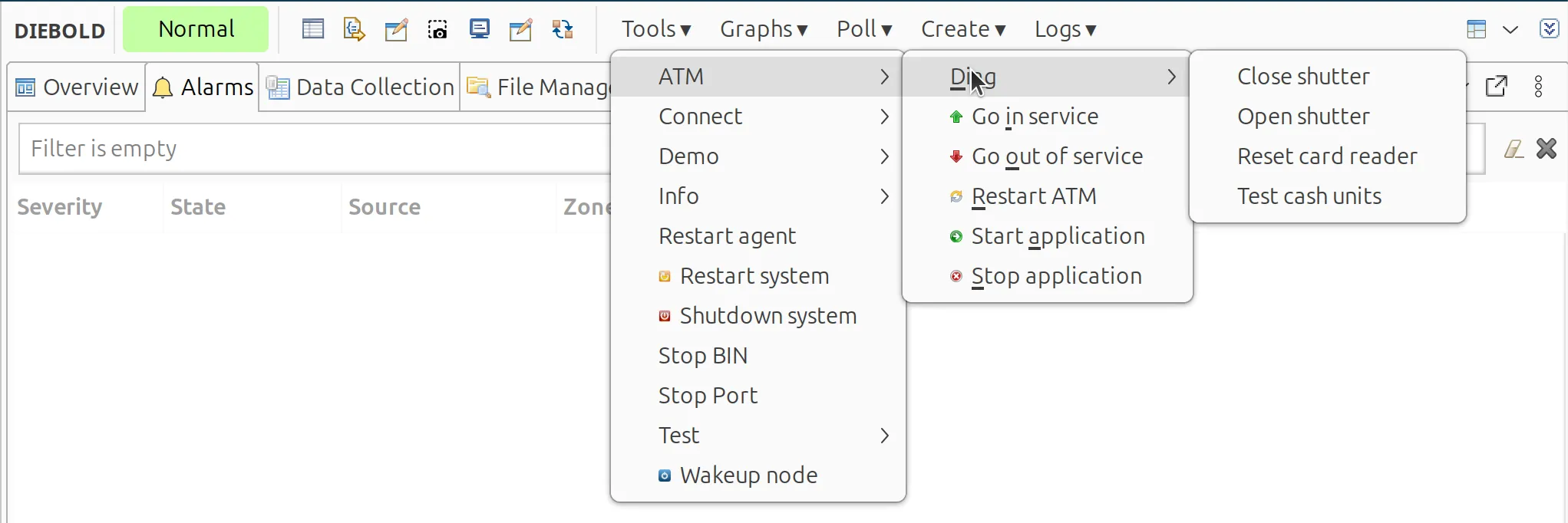

NetXMS is not just a passive monitoring tool. It includes remote management capabilities that reduce the need for on-site visits.

Administrators can remotely reboot terminals, restart services, or execute system commands. Software updates and security patches can be deployed across entire networks at once. Promotional content and media files can be uploaded in bulk. Specialized ATM functions like card ejection or diagnostic routines can be triggered remotely.

The system can also execute automated responses to specific conditions — for example, automatically rebooting a terminal that becomes unresponsive or disabling an ATM that detects a potential security threat.

Integration and Flexibility

NetXMS is built with integration in mind. Comprehensive APIs allow connection to existing banking systems, ticketing platforms, security systems, and third-party applications. A plugin architecture supports custom extensions for specialized requirements.

The platform runs on Linux, Windows, AIX, and cloud environments, fitting into existing IT architectures rather than requiring infrastructure changes.

Security and Compliance

All data transmission between ATMs and monitoring servers uses industry-standard encryption. Role-based access control ensures that staff can only access functions appropriate to their responsibilities. Detailed audit trails track all system interactions, configuration changes, and administrative actions — essential for regulatory compliance and security investigations.

Threat detection capabilities can identify unusual access patterns or suspicious activities, with custom rules tailored to specific operational environments.

Implementation Process

Custom implementations start with an assessment of existing infrastructure and requirements. During design, NetXMS engineers work with client teams to develop specifications for custom features and integrations. Testing validates system performance and security before deployment, often through pilot programs that allow fine-tuning based on real-world use.

Ongoing support ensures that solutions continue to perform as requirements evolve.

Looking Ahead

We envision that ATM monitoring requirements will continue to grow more sophisticated. Enhanced security measures, better personalization, and demands for operational efficiency all push toward more capable monitoring platforms.

With NetXMS 6’s AI capabilities, predictive analytics and natural language interaction become practical tools for ATM operations. Less technical staff can access the information they need. Potential problems can be identified before they affect customers.

And the flexibility to customize means the platform can adapt as requirements change.

For more information about NetXMS ATM monitoring solutions, contact the team at [email protected].