This is a brief overview of some trends in the ATM world. We’ll explore how these trends impact financial institutions that supply services to end-clients. And us, the vendors of ATM monitoring solutions.

Short Intro to Raden Solutions

Many NetXMS users might know the solution for its open-source network monitoring platform. For those unfamiliar with the commercial side of our company, let me provide a brief introduction.

Based in Riga, Latvia, we work globally through partners and representatives. We offer comprehensive network and device monitoring solutions to clients worldwide, from the USA to Australia.

We serve clients from various industries, not just banks. Our clientele includes telecoms, managed service providers, internet service providers, governmental institutions, and even some industrial and energy companies.

Complex monitoring solutions and deploying them in different type of environments is what we are great at. And professionally supporting the NetXMS deployments afterwords.

Trends in the ATM Market

Let’s shift our focus to the trends in the ATM market and how we, as suppliers of ATM monitoring solutions, keep up with these trends.

Centralized ATM Monitoring

In some markets, we still need to explain why a centralized comprehensive ATM monitoring solution is better than the monitoring features of the ATM’s host system.

However, clients gradually recognize the need for a more powerful monitoring and management solution that seamlessly integrates into the bank’s existing infrastructure.

ATM host systems, while supporting monitoring to some extent, have significant drawbacks. They are not easy to integrate into a centralized monitoring system, making it difficult for operators and administrators to track indicators and alert messages.

Their functionality is limited to the management software installed on the ATM, meaning they cannot access specific ATM operations and error indicators if not supported by the terminal software.

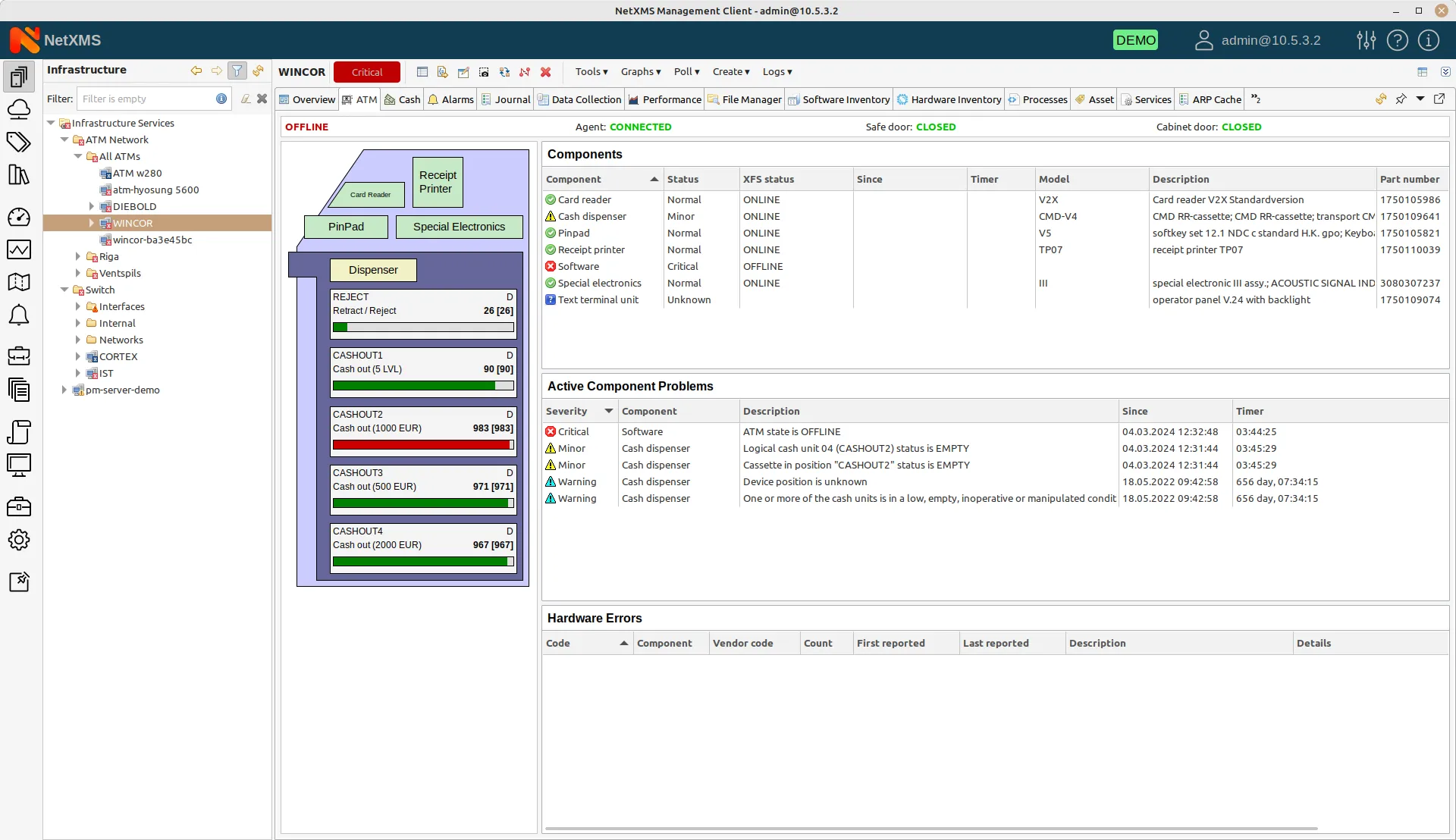

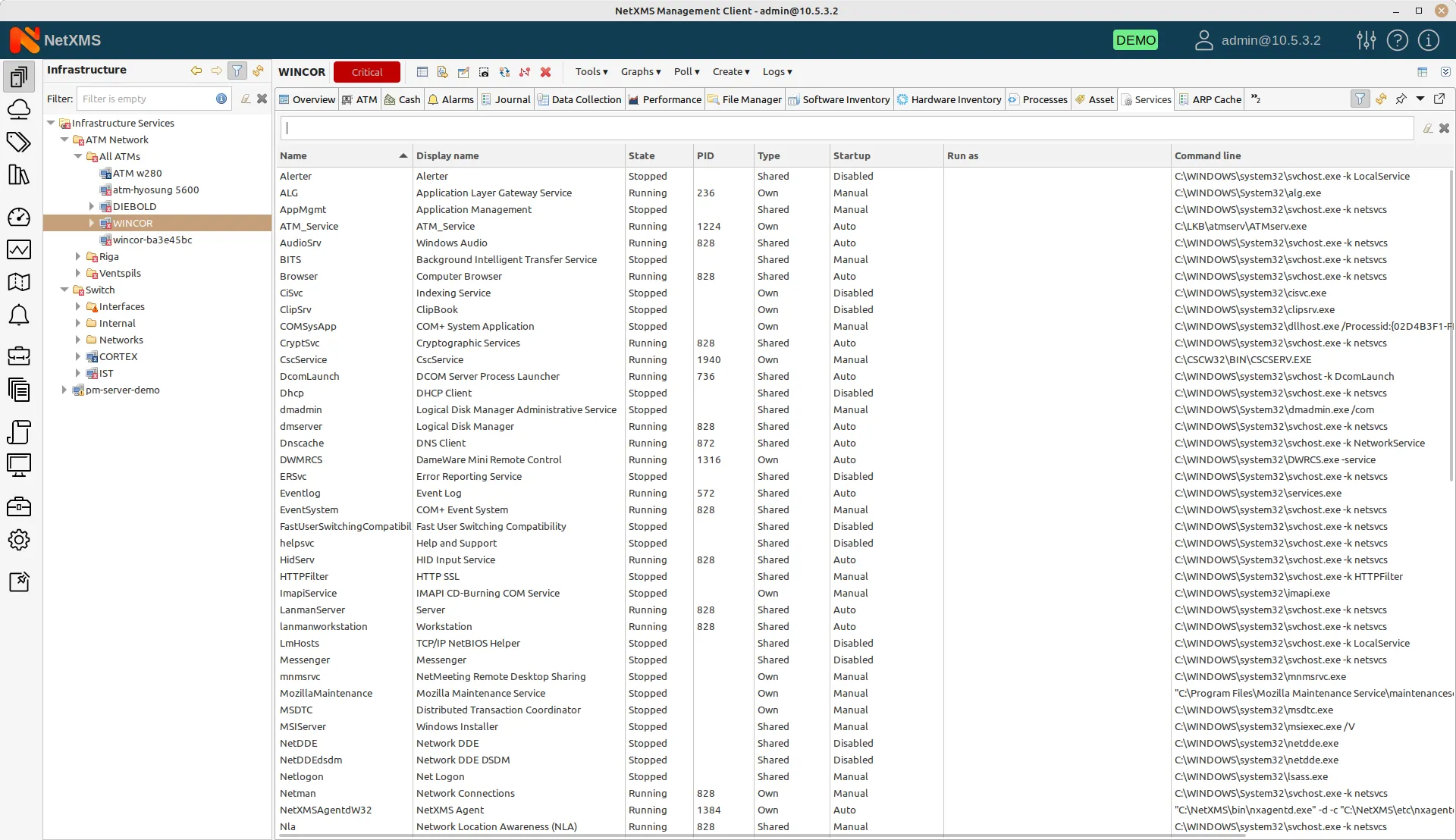

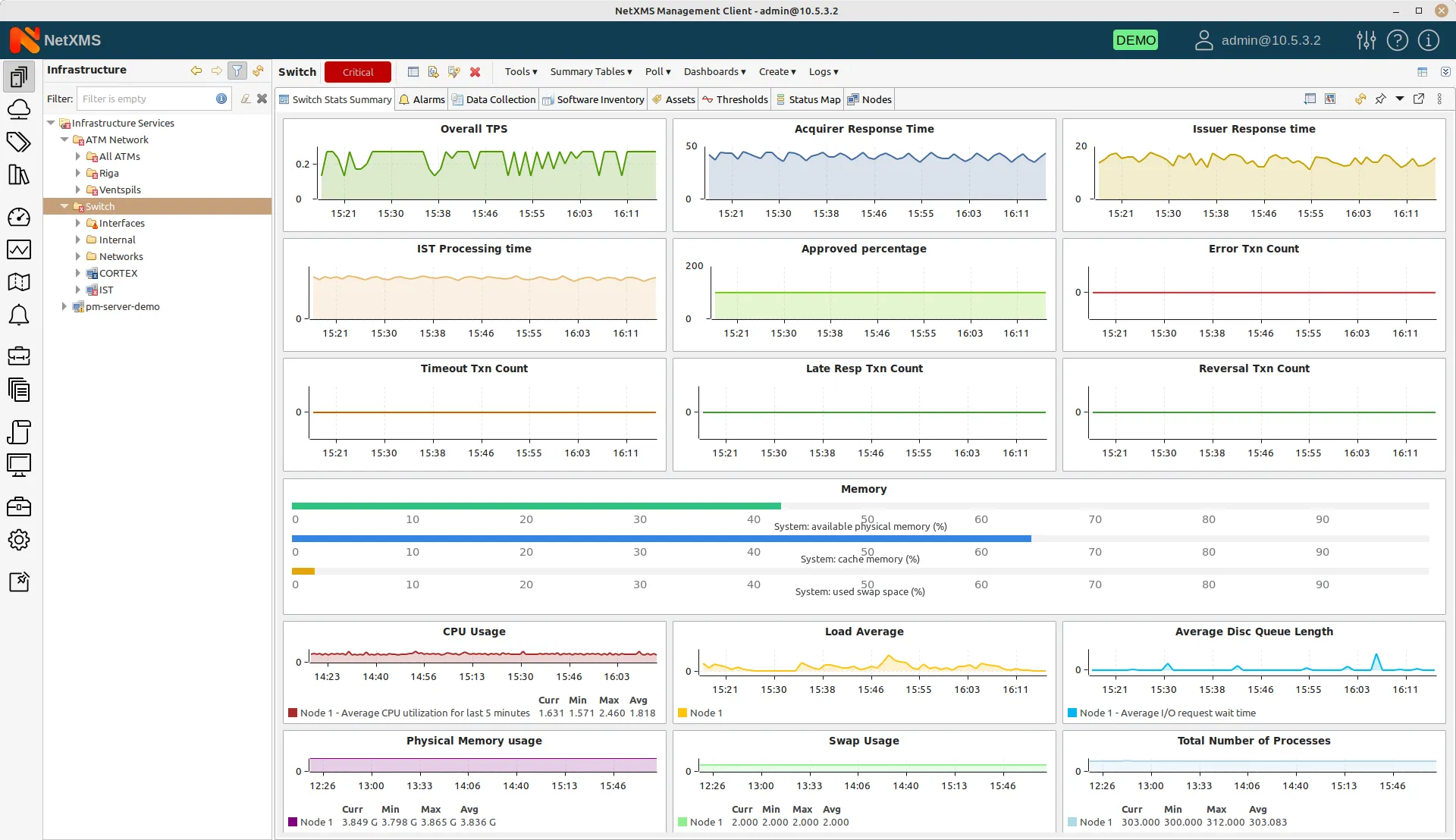

In contrast, agent-based ATM monitoring systems like NetXMS, does not have these limitations.

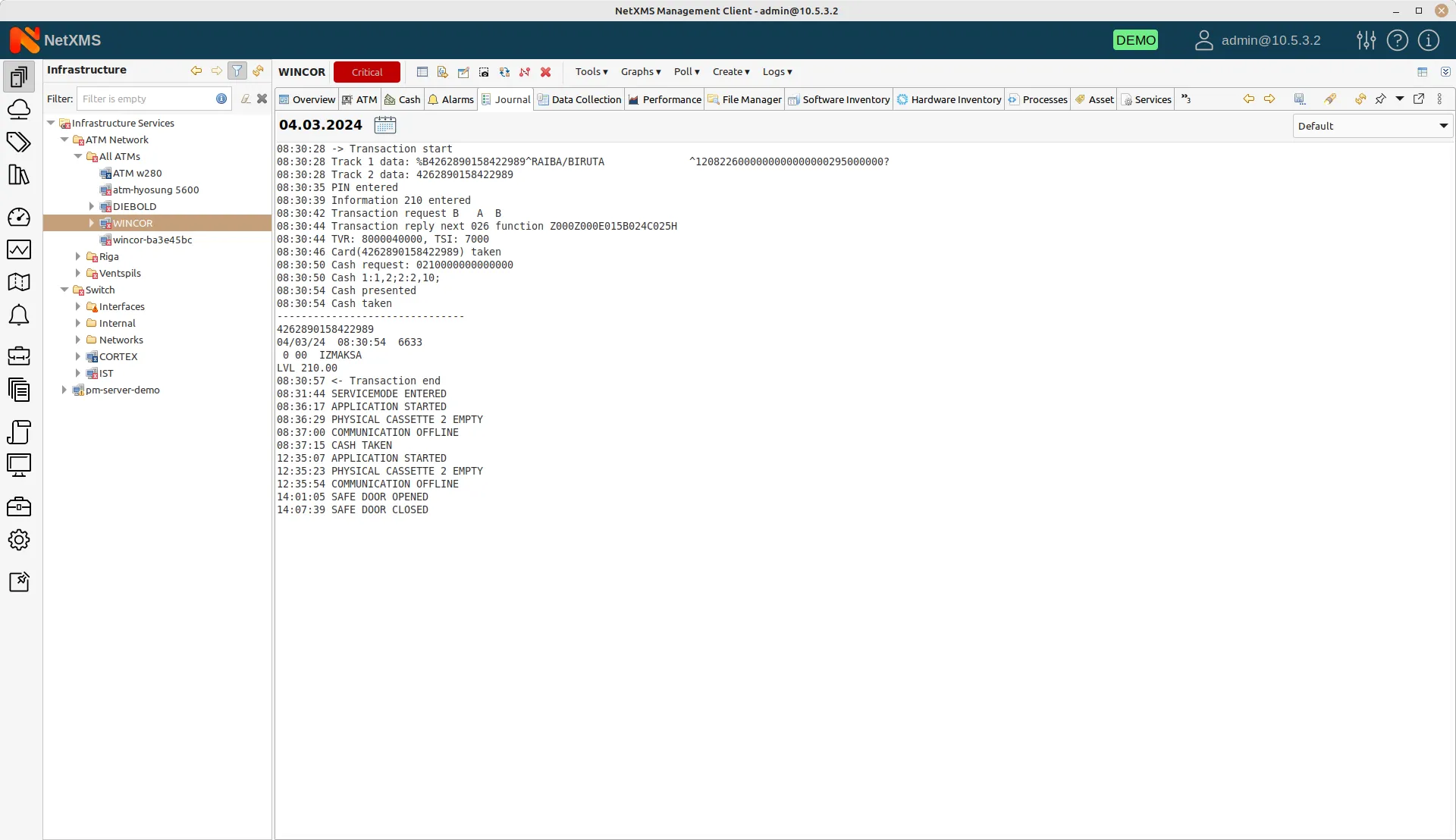

NetXMS can receive all the necessary information from the agent installed on the ATM, independent of the ATM host software. It also synchronizes the Electronic Journal almost in real-time, giving banks access to registered transactions even if an ATM is offline.

NetXMS can access every aspect of the ATM’s operations using its own terminal add-on software, providing much more information than an ATM host system.

Cash Management

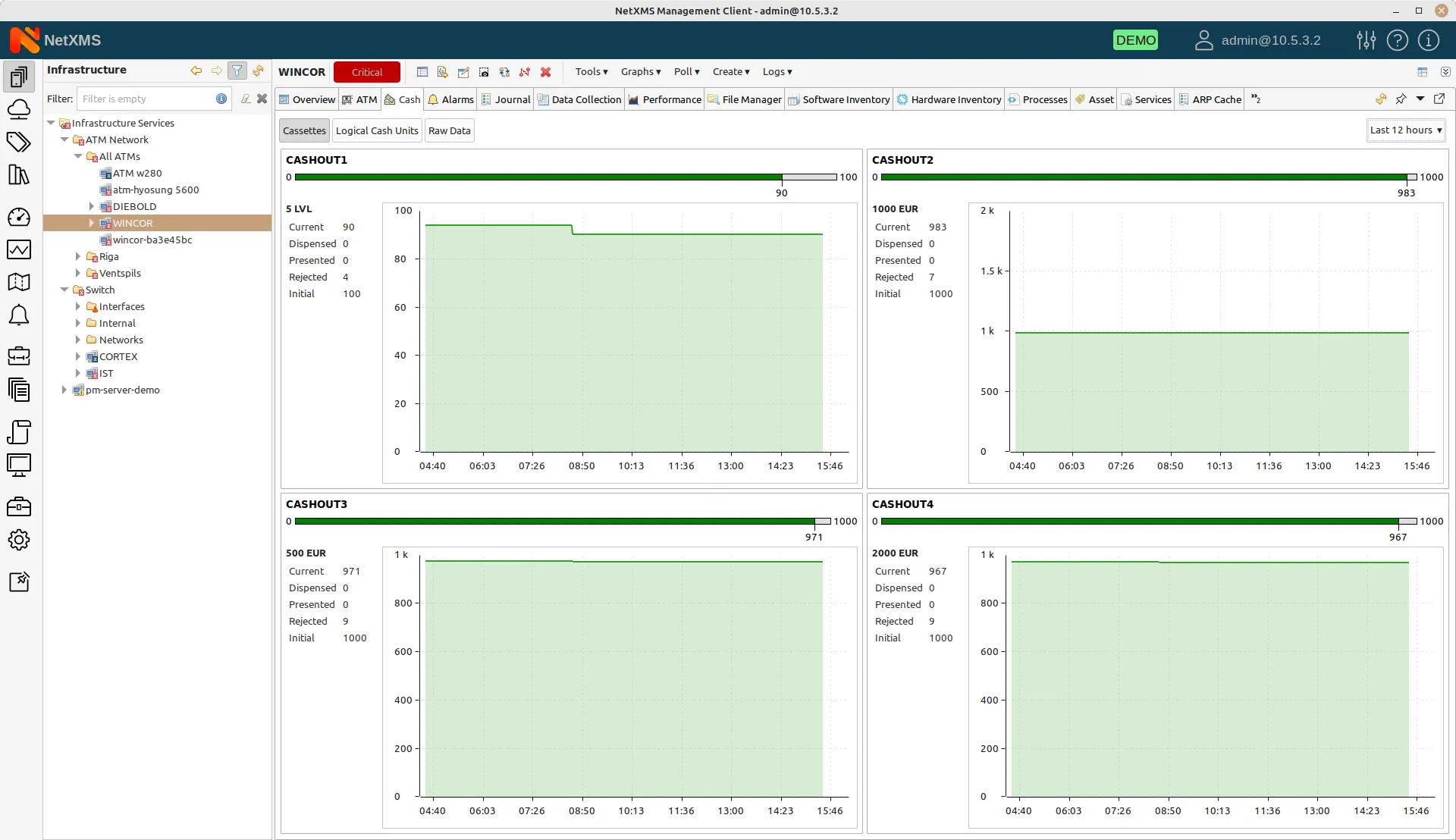

Another trend that resonates with many is cash management. Financial institutions face increasing costs associated with managing cash, both in labor costs and interest rates. They seek new tools and processes to improve operational efficiency.

A significant trend in this respect is cash replenishment and cash prediction. Traditionally, ATMs were replenished according to a schedule, which was inefficient.

A comprehensive monitoring system like NetXMS provides current status and historical data of cash, allowing operators to make informed decisions about cash replenishment and its timing.

Moreover, monitoring systems can use statistics, historical data, and machine learning to prompt cash replenishment, further enhancing efficiency.

While comprehensive cash management systems exist, they are expensive and require regular expert involvement and calibration. Smaller ATM networks may find it more efficient to look for some of that functionality in their monitoring solution.

NetXMS ATM monitoring system can deliver custom linear projections of cash replenishment and alert responsible persons about reaching low cash levels.

Mobile Integration and Authentication

The development of mobile authentication methods and digital wallets drives another trend.

According to the 2023 ATM Software Trends Report, many banks now use mobile integration, fingerprint biometrics, facial recognition, and contactless technologies to enhance the ATM customer experience.

Omnichannel experiences have become vital in retail banking. Customers expect to flow seamlessly between channels to achieve their desired results.

For example, initiating a withdrawal transaction from a mobile banking app and collecting cash from an ATM should be seamless and consistent.

From a monitoring system vendor’s perspective, NetXMS is absolutely ready for these types of integrations. We already have customers using NetXMS to monitor devices like contactless readers and iris scanners.

We have also developed a monitoring app, allowing administrators to solve their ATM-monitoring and management tasks on the go.

Artificial Intelligence (AI) in ATM monitoring

Now, let’s address the elephant in the room: AI. While many expect AI to “do everything,” our expectations are largely shaped by generative AI, which generates results but not necessarily accurate ones.

For finance-related tasks, precision and exact facts are crucial. That’s why we at NetXMS invest in machine learning (ML) based on hard data and exact science.

For ATMs, AI is still in its early stages. It is expected to be particularly useful for combating fraud, improving maintenance schedules, and providing individualized offers to customers.

However, the success of such projects depends on data availability, bank cooperation, and budget. The most efficient approach would involve working with data at the market level, not just one institution.

Interactive Video Teller ATMs (IVTs)

Recently, banks have focused on reducing operating expenses by decreasing the number of branches in their network. As a result, we see more interactive video teller ATMs (IVTs) being deployed.

While this trend is not yet prominent in many regions, it is significant in markets like the United States. For example, a bank in Kuwait that laso uses NetXMS system for monitoring, uses video banking to open accounts remotely.

Outsourcing ATM Fleets

Another trend is outsourcing ATM fleets. Banks that don’t want to deal with the headache of servicing a fleet of ATMs outsource this function completely and get limited access to the rented ATMs.

In many smaller markets, this solution tends to be more efficient. NetXMS, being a multi-tenant system, is well-suited for this need.

Fully Integrated ATM Solution

Finally, let’s talk about a fully integrated ATM solution. Integrated into a bank’s infrastructure from one side, and into seamless customer journey, on the other.

Imagine an integrated ATM and cash ecosystem that provides seamless journeys around everyday financial use cases for both consumers and businesses.

Users can use their phones to withdraw cash from the ATM, converging digital and physical payment worlds. Financial institutions aim to minimize customer journeys across several touchpoints.

NetXMS, as a vendor-agnostic ATM monitoring software, allows financial institutions to streamline operations, reduce errors, and help in faster incident resolutions. Every ATM is on its way to becoming an intelligent branch.

In conclusion, we are seeing the need for an integrated ATM and cash ecosystem: hardware, software, and cloud services that work together.

NetXMS seamlessly integrates into the stack of financial institution’s services, making it future-ready.